What exactly is Options Exchange? Ideas on how to Exchange Alternatives

Posted on September 24th, 2025 by admin in Uncategorized | No Comments »

OTC means the choices is traded in person ranging from a couple parties and you can instead of a central change otherwise broker. “The pros have you been makes a bit additional money to the investing in the new temporary,” Moyers claims. “The brand new scam is you you’ll lose everything, based on how you structure the options trading.” For their possibility outsized productivity or losings, traders is always to make sure it completely understand the potential ramifications prior to typing to the one possibilities ranks. Should your stock cannot slide lower than $fifty, or if in reality they rises, probably the most it is possible to lose is the $2.00 advanced.

As a result, alternatives people must take into account this type of charge when it comes to the fresh profitability out of a strategies strategy. A lower struck price have much more built-in well worth to have phone call possibilities since the alternatives offer enables you to find the inventory from the a good discounted than it’s trading for today. If the inventory’s rate stays $a hundred, your call options are inside the-the-currency, and you will purchase the inventory for a cheap price. A choice you buy are a binding agreement that gives you certain legal rights.

Phone calls compared to. Sets

Which possibility of magnifying your development is the reason why options change therefore interesting. Here’s simply how much a trader will make from the expiration, as the a purpose of the fresh stock rate. Based inside 1993, The new Motley Fool is https://www.ufficio-brevetti.it/2025/09/16/all-the-rocket-category-product-rates-to-the-xbox-360-console-rl-change/ actually an economic characteristics organization dedicated to and make the world wiser, pleased, and you may wealthier. The brand new Motley Fool has reached thousands of people each month thanks to our premium paying choices, totally free information and you can business study for the Fool.com, top-rated podcasts, and you will non-funds The brand new Motley Fool Basis.

What is the difference between sets and you may calls?

- You’d along with take a look at items for instance the intrinsic value of the possibility, meaning simply how much you might obtain otherwise remove in the event the workouts instantaneously, and weigh if your advanced seems really worth the exposure.

- It matter isn’t and cannot end up being construed while the an enthusiastic render to buy otherwise promote people shelter.

- Like all financing possibilities you create, you should have an obvious concept of everything you hope to doing prior to change possibilities.

- NerdWallet, Inc. doesn’t give consultative or broker services, nor can it strongly recommend or indicates people to find or offer type of brings, ties or other investment.

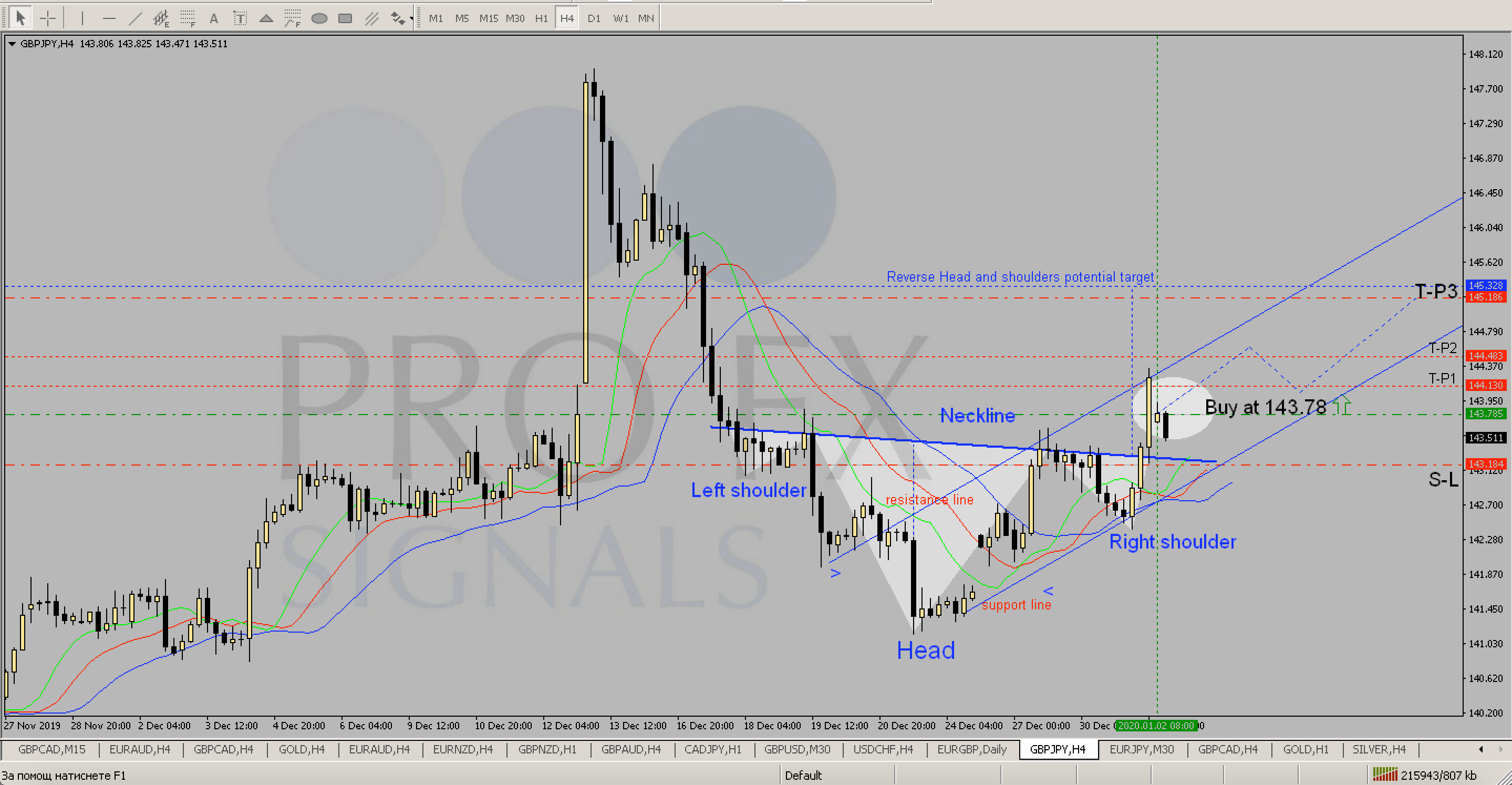

- Less than is actually a map which have an additional example, and understand the money/losings change because you circulate their cursor over the line.

- If you opt to hold up until expiration, the choice both ends worthless otherwise production money whenever resolved for the expiration go out.

Solution exchange tips work best when an investor makes use of simply an excellent number of the offered funding on the anybody exchange. An alternative choice Greek, theta procedures an alternative package’s decrease in speed along the next a day due to time decay. This is the level of option deals which have transacted today on this specific deal. Contracts that have an amount of less than 100 each day you’ll find large develops amongst the bid as well as the query costs. Specific brokers can get request you to over a questionnaire and take an internet course to exhibit your understanding from choices trading. All for example requirements try stipulated because of the representative just to perform its risk.

Is Alternatives Exchange Suitable for Myself?

In return for supplying the choice manager the authority to buy or sell an investment at the a particular price, they discovered a made for attempting to sell you to definitely alternative. The possibility author emerges earnings from the advanced they received because of their obligation in this deal. You could potentially trade alternatives thanks to brokerages, just like you could potentially get holds, securities, and you can finance offers. As they agree to generate the brand new offer you hope to buy—and you may have the premium you have to pay.

Frequently asked questions on the alternatives trading

Furthermore, in the event the a trader desires insurance coverage to their S&P five hundred directory profile, they are able to pick place choices. The fresh a shorter time there is up until expiration, the brand new quicker well worth an option can get. For the reason that the possibilities of a price disperse regarding the root stock disappear while we draw nearer to expiration. If you purchase a one-month option that’s out from the currency, plus the inventory doesn’t move, the possibility will get quicker worthwhile with each passageway day. It’s one step more than only to find carries or directory money to have long-name growth, however it doesn’t bring the fresh risky away from much more speculative leveraged alternative steps.

Or you might retain the new shares to see if the the cost increases even further. In any event, there’ll be made use of your decision to find Red-colored Pizza offers from the a below-market value. People to shop for a tips deal try long on one thing as they expect the newest resource to do in how they need more the size of the choices deal. The option blogger, at the same time, will not consider the new asset is going to do in how the possibility owner anticipates, so they’ve been short. Before you go first off alternatives change, prefer an agent that gives lowest for each-deal fee for choices, in addition to search and you can devices which will help publication what actions you select along the way. Alternatives change is proven to be a bit high-risk, in part on account of just how complex it can be to understand.

Nevertheless these payouts is capped because the stock’s price usually do not fall less than no. The brand new loss are capped while the buyer is allow options end worthless if prices move around in the opposite advice. Illiquid options are hard to purchase or offer efficiently and quickly, while you are water choices are positions which might be very easy to go into and you will log off rapidly.

The duty to purchase a hundred shares for each and every deal will likely be extreme to own higher-charged stocks. Also, the newest controls approach ties up funding (cash-protected places and you may possessed offers), which means you have to be comfortable with one liquidity restriction. Place uncommon alternatives hobby because of the looking because of a strategies strings so you can view the details about regularity, implied volatility, and unlock attention.

The facts out of options trading is going to be shocking, which is useful discover how it works in practice. Including, a visit to your SPY with an attack cost of 450 and you can a conclusion time of just one week when the most recent price is 449 are certain to get a high advanced than just a call which have a strike out of 460 as well as the exact same expiration go out. Phone calls with an expiration time far later on may also are apt to have lower premium. Choosing the need harmony anywhere between premium, hit rates, and you can termination times is but one part of conducting research to the alternatives and certainly will are different based on your aims. Options might be exchanged to own many lending products, in addition to ETFs, indicator, and you may equities. Change possibilities concerns having fun with individuals ways to either make the most of specific field moves or hedge current positions from the place industry.

Yet not, if your individual try ready to endure specific level of disadvantage chance, choosing a less costly out-of-the-money (OTM) option such as the $40 put may also performs. In such a case, the expense of the option condition would be dramatically reduced in the merely $2 hundred. At the same time, in case your hidden price decrease, the newest buyer’s collection reputation loses worth, however, that it losses is largely safeguarded because of the acquire from the set alternative reputation. And that, the career can also be efficiently be looked at as an insurance strategy. Inside the a short put, the newest buyer often produce an option gambling to your an expense boost and sell it so you can buyers.

- Sometimes, the choice proprietor can be generate income after they get phone call choices otherwise become an ideas creator.

- The newest strike price is the cost the underlying often transact on exercise/task.

- For many traders and you can investors, alternatives can appear mystical and also fascinating.

Gamma (Γ) means the pace of alter between a keen option’s delta and also the hidden asset’s price. Gamma indicates the amount the brand new delta manage changes provided a good $step one relocate the underlying shelter. Let’s assume an investor are much time you to definitely call solution to your hypothetical inventory XYZ. Therefore, if inventory XYZ grows or decrease because of the $step 1, the call option’s delta do boost otherwise decrease by 0.10.