Mastering Swing Trading in Forex Strategies for Success 1808459938

Posted on November 1st, 2025 by admin in trading7 | No Comments »

Mastering Swing Trading in Forex: Strategies for Success

In the fast-paced world of Forex trading, swing trading has emerged as a favored strategy among traders looking to capitalize on both short- and medium-term market movements. This method allows traders to enter and exit trades within a timeframe ranging from a few days to several weeks. By understanding the principles of swing trading and implementing effective strategies, you can significantly enhance your trading performance. For those seeking a reliable platform for their trading activities, consider the swing trading forex LATAM Trading Platform.

What is Swing Trading?

Swing trading is a trading style that aims to capture price movements or “swings” in the market. Unlike day trading, which requires constant monitoring of positions, swing trading allows for more flexibility as trades are held for longer periods. Traders using this strategy analyze price charts to identify potential entry and exit points based on market trends and technical indicators.

Benefits of Swing Trading in Forex

- Less Time-Intensive: Swing trading doesn’t require the constant attention that day trading does, making it suitable for those with other commitments.

- Potential for High Returns: By capturing larger price movements, swing traders can achieve substantial profits within shorter periods.

- Flexibility: Traders can adapt their strategies based on market conditions, making it versatile for different trading styles.

Essential Strategies for Successful Swing Trading

1. Technical Analysis

Technical analysis plays a crucial role in swing trading. Traders often analyze price charts, using various indicators such as moving averages, Bollinger Bands, and RSI (Relative Strength Index) to identify potential entry and exit points. Understanding candlestick patterns can also provide insights into market sentiment and potential reversals.

2. Trend Identification

Identifying trends is essential for swing traders. Swing trading strategies often align with the prevailing market trend, whether it’s bullish or bearish. Traders should look for patterns that indicate a strong trend and avoid trading against it unless they have a solid strategy for reversal.

3. Setting Entry and Exit Points

Successful swing traders develop clear entry and exit strategies. This involves determining optimal entry points based on technical indicators and setting take-profit and stop-loss orders to manage risk effectively. A well-defined exit strategy allows traders to lock in profits and minimize losses.

4. Risk Management

Proper risk management is vital in swing trading. Traders should define their risk tolerance and determine the percentage of their trading capital they are willing to risk on a single trade. Using stop-loss orders helps protect against significant losses, ensuring they stay within their risk parameters.

Tools and Resources for Swing Traders

To succeed in swing trading, traders can utilize various tools and resources. These include:

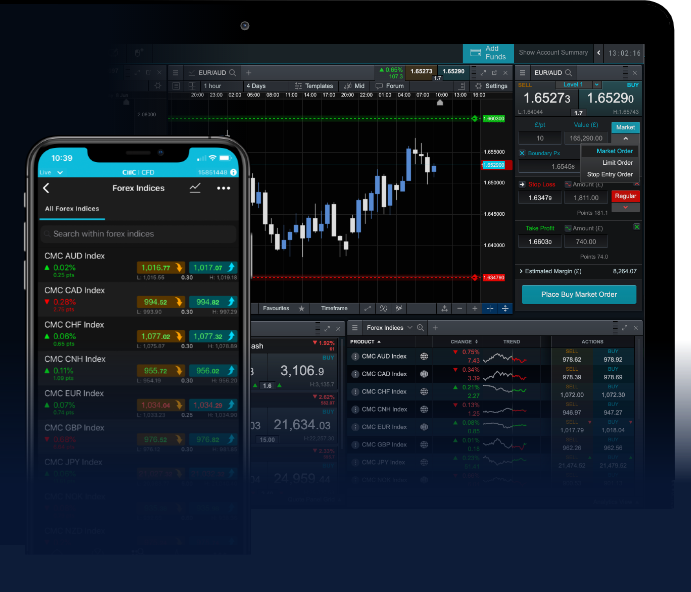

- Trading Platforms: Choose a reliable trading platform that offers advanced charting tools, real-time data, and a user-friendly interface, such as the LATAM Trading Platform.

- Economic Calendars: Staying informed about economic events and news releases is crucial for anticipating market volatility and making informed trading decisions.

- Educational Resources: Continuous learning through webinars, online courses, and trading forums can enhance trading skills and knowledge.

Common Mistakes to Avoid in Swing Trading

1. Overtrading

Swing traders should avoid the temptation to enter too many trades at once. Overtrading can lead to increased transaction costs and emotional stress, ultimately impacting decision-making.

2. Ignoring Market Conditions

Traders must consider the overall market conditions before executing trades. Ignoring market trends or economic news can result in poor trading outcomes. Always stay informed and aware of global events that may impact the Forex market.

3. Failing to Adapt

The Forex market is dynamic and can change rapidly. Swing traders should be ready to adapt their strategies based on evolving market conditions, rather than sticking rigidly to a plan that may no longer be relevant.

Developing Your Swing Trading Plan

A well-structured trading plan is essential for success in swing trading. Your plan should include your risk management strategy, entry and exit rules, and criteria for selecting currency pairs to trade. Additionally, it’s vital to keep a trading journal to document your trades, analyze your performance, and identify areas for improvement.

Conclusion

Swing trading offers an enticing opportunity for Forex traders to profit from market fluctuations without the constraints of day trading. By employing effective strategies, maintaining discipline, and utilizing the right tools, you can enhance your swing trading skills and achieve your financial goals. As you embark on your swing trading journey, consider leveraging platforms like the LATAM Trading Platform to optimize your trading experience and maximize your potential for success.