Top Indicators for Successful Forex Trading 1501970860

Posted on November 10th, 2025 by admin in trading16 | No Comments »

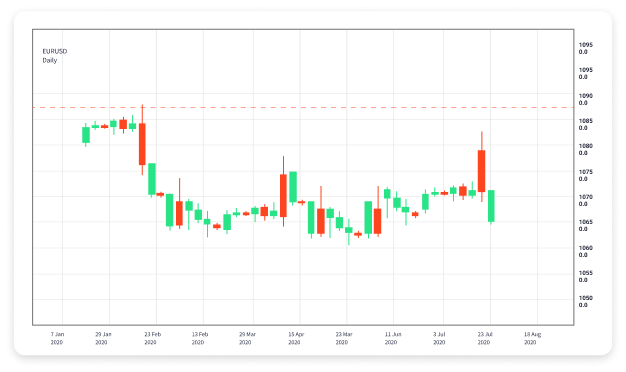

In the world of forex trading, utilizing best indicators for forex trading Trading Platform VN the right indicators can significantly affect your trading performance. Indicators serve as analytical tools that can help traders make informed decisions based on market data. This article explores some of the best indicators for forex trading, explaining each one’s purpose, how to interpret them, and how they can fit into your trading strategy.

1. Moving Averages (MA)

Moving averages are one of the most widely used indicators in forex trading. They smooth out price action by filtering out the “noise” from random price fluctuations. The most common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

The SMA calculates the average price over a specific number of periods, while the EMA gives more weight to more recent prices, making it more responsive to recent price changes. Traders often use moving averages to identify trends, determine support and resistance levels, and create crossover signals for potential buy or sell opportunities.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. An RSI above 70 indicates that an asset may be overbought, while an RSI below 30 suggests it may be oversold.

Traders use the RSI to find potential reversal points in the market. For instance, if an asset is in an uptrend and the RSI hits 70, it might signal that the price could start falling soon, prompting traders to consider selling.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that are standard deviations away from the middle band. This indicator allows traders to assess market volatility and potential price reversals. When price touches the upper band, it may be overbought, while touching the lower band can indicate an oversold condition.

Traders can use Bollinger Bands to enter trades when the price touches the outer bands combined with other indicators like RSI or MACD for confirmation.

4. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of two lines: the MACD line and the signal line. The standard MACD settings use the 12-day and 26-day EMAs. When the MACD line crosses above the signal line, it generates a bullish signal, and vice versa for bearish signals.

Traders often look for divergence between the MACD and the price to find potential reversal signals. When prices make a new high, but the MACD does not, it may indicate weakening momentum.

5. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of an asset to a range of its prices over a certain period. The result is scaled between 0 and 100. Generally, readings above 80 indicate an overbought market, while readings below 20 indicate an oversold market. This indicator helps traders identify potential reversal points.

Traders can use the Stochastic Oscillator in conjunction with other indicators for better accuracy in their trading decisions.

6. Fibonacci Retracement

Fibonacci retracement levels are horizontal lines that indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction. The levels are derived from the Fibonacci sequence and are typically set at 23.6%, 38.2%, 50%, 61.8%, and 100%.

Traders often use these levels to identify potential reversal points and to set their entry and exit points based on the likelihood of price retracements occurring around these levels.

7. Average True Range (ATR)

The Average True Range measures market volatility by decomposing the entire range of an asset price for that period. It does not indicate the direction of price movement but rather the volatility. A higher ATR indicates a more volatile market, while a lower ATR suggests less volatility.

Traders often use ATR to set stop-loss orders; for instance, if the ATR is high, they may set wider stop-loss orders to account for larger price swings.

8. Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that shows support and resistance levels, trend direction, and momentum all in one view. It consists of five lines that provide various signals, including crossovers and trend strength.

The cloud itself (Kumo) can indicate whether an asset is in an uptrend or downtrend based on its location relative to the cloud. Many traders utilize this indicator to provide a clear picture of market conditions.

9. Parabolic SAR

The Parabolic SAR (Stop and Reverse) is used to determine the direction of an asset’s price and to provide potential reversal signals. The SAR appears as dots on the chart above or below the price. When the dots are below the price, it suggests an uptrend, and when they are above the price, it indicates a downtrend.

This indicator is effective for traders looking to set trailing stop losses to maximize profits during trending markets.

10. Volume Indicators

Volume indicators reveal the strength of a price movement. Traders often use volume to confirm trends based on price movements. For example, if price is increasing but volume is decreasing, it might indicate that the trend lacks strength and could reverse.

Combining volume indicators with price action can help traders make more informed decisions in their forex trading strategies.

Conclusion

While there are numerous indicators available to forex traders, it’s essential to understand that no single indicator is foolproof. It’s beneficial to combine several indicators and understand their interactions for a more comprehensive trading strategy. As you refine your approach, experimenting with these indicators will help you determine which best aligns with your trading style and goals. Always remember to backtest your strategies before applying them to live trades, and stay updated on market conditions to make the most informed decisions.