What’s Move Change?

Posted on September 17th, 2025 by admin in Uncategorized | No Comments »

That it music easy the theory is that, but while the people that has replaced real areas knows, doing this plan efficiently demands expertise, perseverance, plus the proper knowledge. First, specific steps run out of merit and therefore are only anyone’s personal look at precisely what the field need to do. Subsequently, certain actions interest exclusively for the to purchase criteria rather than due to the get off, leading them to partial options.

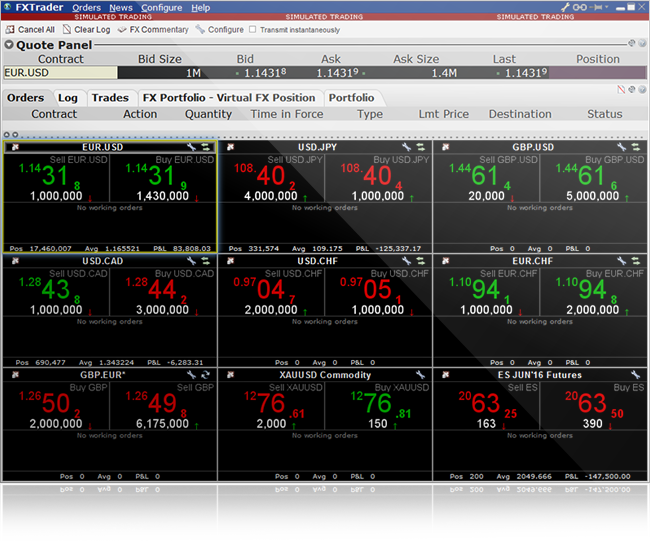

A 2013 study discovered that organization-peak swing deals increased cost informativeness and you will generated profits just after will cost you. However, move trading confronts high risks, and right away speed pit publicity, unanticipated business volatility, incorrect technology breakouts, and you will emotional decision-and make challenges. Industry statistics imply that just 10% of productive investors go enough time-label uniform profits. Newbies would be to begin by discovering key values away from tech analysis, carrying out an organized trading package, and you may doing that have simulated trial membership. Exposure management laws and regulations restrict exposure to step one–2% for every trade using proper stop-loss positioning. Extremely important products to have swing change tend to be state-of-the-art charting platforms such TradingView, guarantee screeners for example Finviz, and you will in depth trade publications such TraderVue.

- The advantages of having fun with move exchange procedures were improving small-identity money possible, and you may restricted day union.

- Swing levels, as well, will be the peaks or crests you to definitely stick to the lows within the a equivalent period.

- Even though you’re also simply trading right away, you’re also launching yourself to rates actions at once if this’s more complicated so you can change.

- After entering a-swing trade, set a safety avoid fairly alongside the entry way.

- Swing trading works to your an even more expanded timeframe, having ranks away from a couple of days to a few months.

Trade edge ai minimum deposit: Have there been Swing Trading Tips That work Whenever?

Whether or not you’re also new to trade or should refine their approach you’ll make use of proven patterns and you can indications you to definitely laws profitable trades. Swing people can use a Fibonacci retracement sign to recognize prospective reversals, assistance, and you can resistance profile, in addition to put end-losings purchases and put target cost. The fresh Fibonacci retracement ratios away from 23.6%, 38.2%, and you can 61.8% are believed to disclose it is possible to reverse profile. Swing trade is situated more on technical and simple research, when you are day change relies on business belief and speed step. Swing exchange means more lookup and you may believed than simply go out exchange, but also also provides far more possibilities and you may assortment.

What are common mistakes to stop inside the swing trade?

See brokers that provide cutting-edge buy brands such stop-losings and you will limitation orders. Ensure that the software process is quick and you can simple which means you will start trade quickly. Finally, be sure the fresh representative observe the brand new “discover your own buyers” rule to own secure transactions. Provided this type of items can assist introduce a strong foot to own swing trading.

Why is move exchange so hard?

Both, even when the whole trajectory is moving downwards, there may be a small upward direction, which is encashed. Most move buyers count mostly on the tech research however along with trade edge ai minimum deposit combine it which have a simple study, guaranteeing it don’t help any tall money chunk slip away from them. A popular exchange program, TradingView offers various expected systems offering detailed business investigation.

Move Trading Breakout Analogy

Initiate small behavior continuously and allow your trade strategy evolve based for the actual business sense. Which have effort and you may perseverance move trade can become a valuable role of one’s funding approach taking consistent profits while maintaining a well-balanced existence. Work on sectors and you will private carries demonstrating the best relative energy than the wide business indicator. Which cousin electricity may lead in order to expanded popular motions best for swing trading ranks.

The head and you will Arms and you can Double Best are samples of reverse models and you may signify the present upward pattern in cost can get reverse. Continuation patterns, such as, a bullish Pennant, recommend that the existing trend could keep heading, and you will buyers will be trying to find a possible breakout for the upside of the formation. Mix with her scalping and you will swing trading can give you a knowledgeable out of one another planets that with scalp trade for taking advantage of short-term trade opportunities and swing change to journey expanded manner. The newest RSI is also among the best move trade technology signs as it could assume potential rates reversals away from overbought and you can oversold readings.

Field information is provided only to possess informational and you will/otherwise educational motives just. This is not implied because the a suggestion and does not portray an excellent solicitation or a deal to purchase otherwise offer any sort of shelter. Agreements is actually self-led purchases from myself-picked possessions, that may are stocks, ETFs and you can cryptocurrency. Agreements are not information from an idea overall or their private holdings or default allocations. Agreements are built having fun with outlined, mission requirements considering generally approved funding theory; they are not based on your circumstances otherwise exposure character. You’re responsible for installing and you may keeping allocations certainly one of property inside your Package.

Playing with multiple swinging averages along with each other is common inside the swing trading steps. Traders tend to fool around with several swinging averages layer other timeframes. For example, the new nine-time exponential moving mediocre (EMA) plus the 13-date EMA (the brand new EMA loads previous deals far more greatly than simply having a keen SMA). There are several sort of swing exchange tips, per more suitable to certain tools, segments or rates characteristics. Particular buyers and you will means favor calmer, more stable areas, while some check out capitalise on the rapid speed shifts. Particular swing traders as well as use basic study in their method.

Right here, investors are told to keep track of moving averages and you may oscillators. Taking reduced swings will help an investor who has lay a good condition generate payouts. Unlike other types of trade such as date change and long-label trade, one request enough time, swing change is great for investors who are quick punctually, and may be performed area-go out or because the a hobby. A-swing trader has a longer screen that enables your so you can analyse a stock’s results for several days otherwise months. Therefore a swing investor doesn’t should keep taking a look at the industry actions all day long.

Understanding threats and considerations inside move exchange before you begin will assist investors enable it to be. Swing change is actually an investment strategy you to definitely targets small- to average-label industry moves. Instead of date trade, swing trading doesn’t need ongoing overseeing. They use tech and you may basic research to determine when you should get market. Move exchange combines the fresh adventure from short positions on the possibility to make a strong trade package.

Such move change strategy is labeled as channel trade. Bollinger Rings is actually a scientific research unit that uses simple swinging averages, which mirror the common rate way more than a particular timeframe. The newest Bollinger Band include a couple of trendlines plotted a few basic deviations regarding the swinging mediocre and can be used to imply just how overbought otherwise oversold the market is. The newest closer the cost moves to the higher likely, the more overbought the brand new investment is and vice versa. An informed steps mix technical investigation having chance government, such playing with stop-losings orders. Trend-pursuing the and you can breakout steps is well-known among move traders.

Mock trade classes, as well as doing that have papers and pencil, are very important first of all to gain feel and you can derive classes out of simulated trades. Case degree provide a practical angle, helping subscribers understand basics finest. Inside section, we’ll dive to the particular swing trading situation degree, taking expertise to the exchange investigation and you can lessons discovered out of earlier trades. Essentially, move trading performs in every field who’s rate way and you will exchangeability. Enter in the event the marketplace is more than their two hundred-go out moving average and you can functions a new 7 day lower.